Income Organizer (Schedule I & Means Test Forms)

View these videos to get started:

Using the Income Organizer

Schedule I Calculator

Means Test Calculator

Glade’s Income Organizer Overview

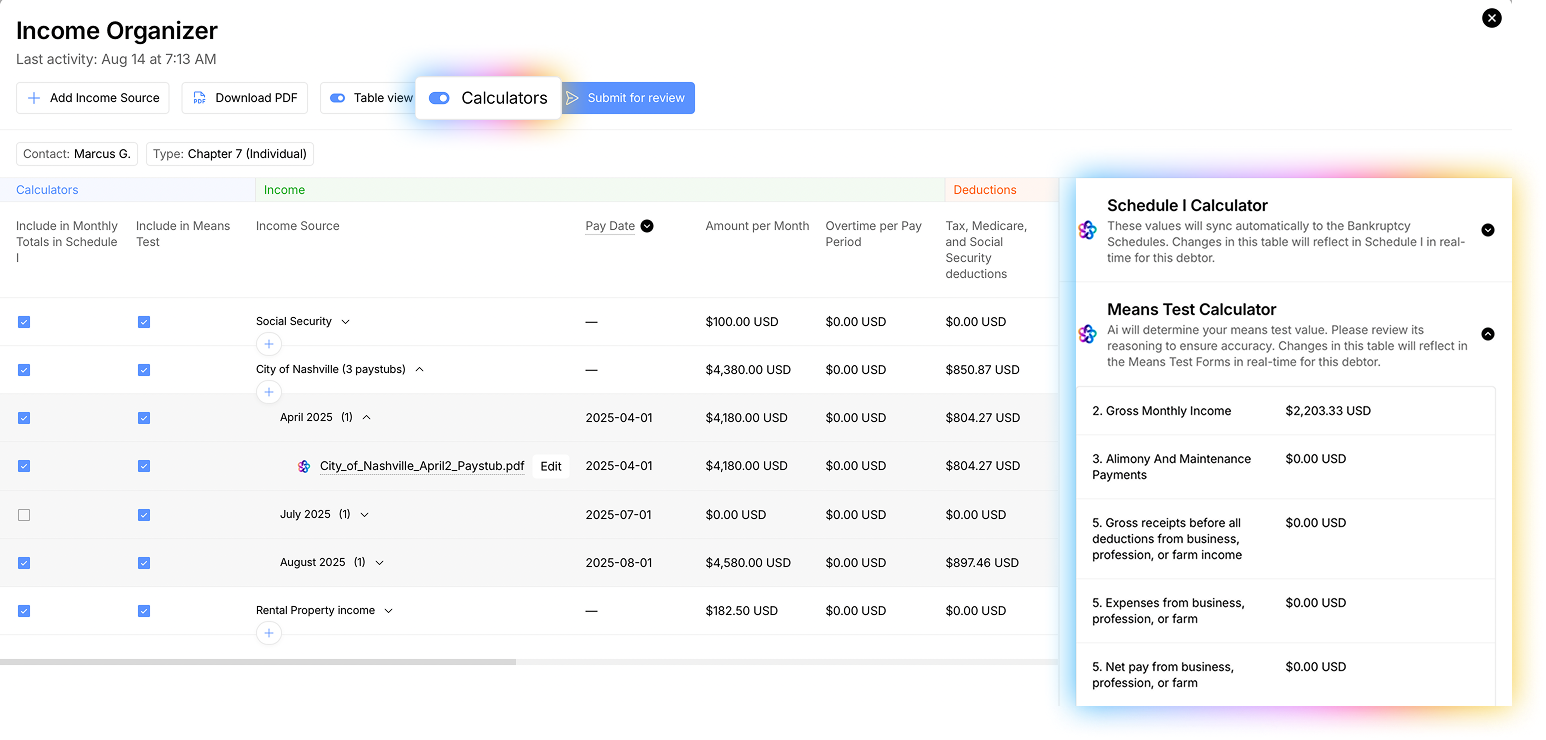

The Income Organizer is a tool within Glade’s workflow that helps you collect and organize client income—primarily pay stubs and other earnings like social security, unemployment, rental income, etc. It works similarly to Glade’s Document Requests, but it's tailored for managing income from one or more sources.

Glade’s AI automatically extracts income data from uploaded documents and enters it into the Pay Table.

Example use case:

Bankruptcy attorneys use the Income Organizer to collect income information from clients - a critical part of filing the final bankruptcy petition.

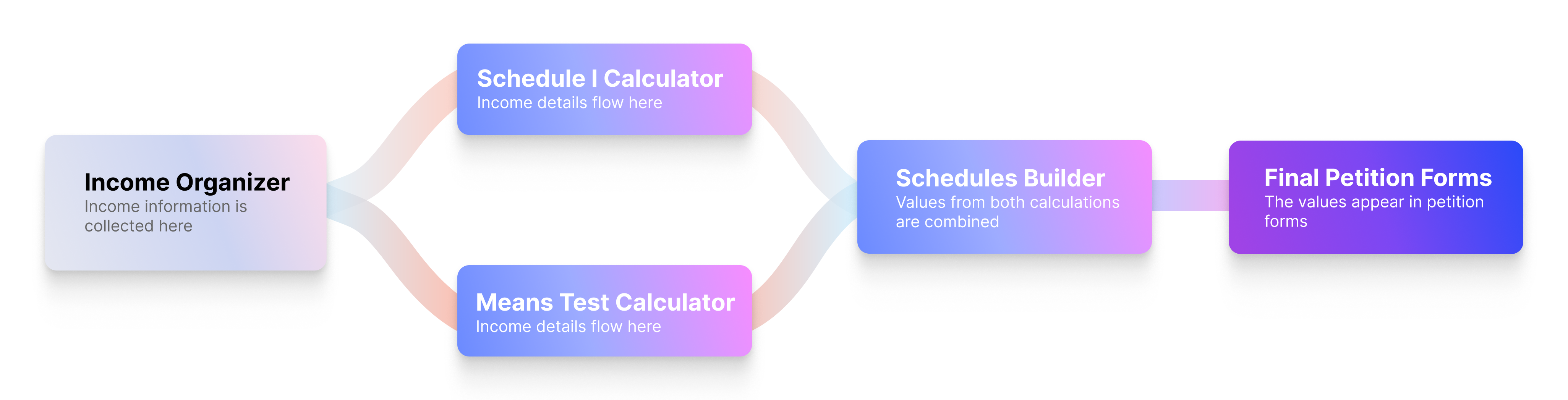

The data collected in the income organizer flows into:

The Schedule I Calculator

The Means Test Calculator

The values in those calculators will flow into the Schedules Builder and appear in the final petition forms.

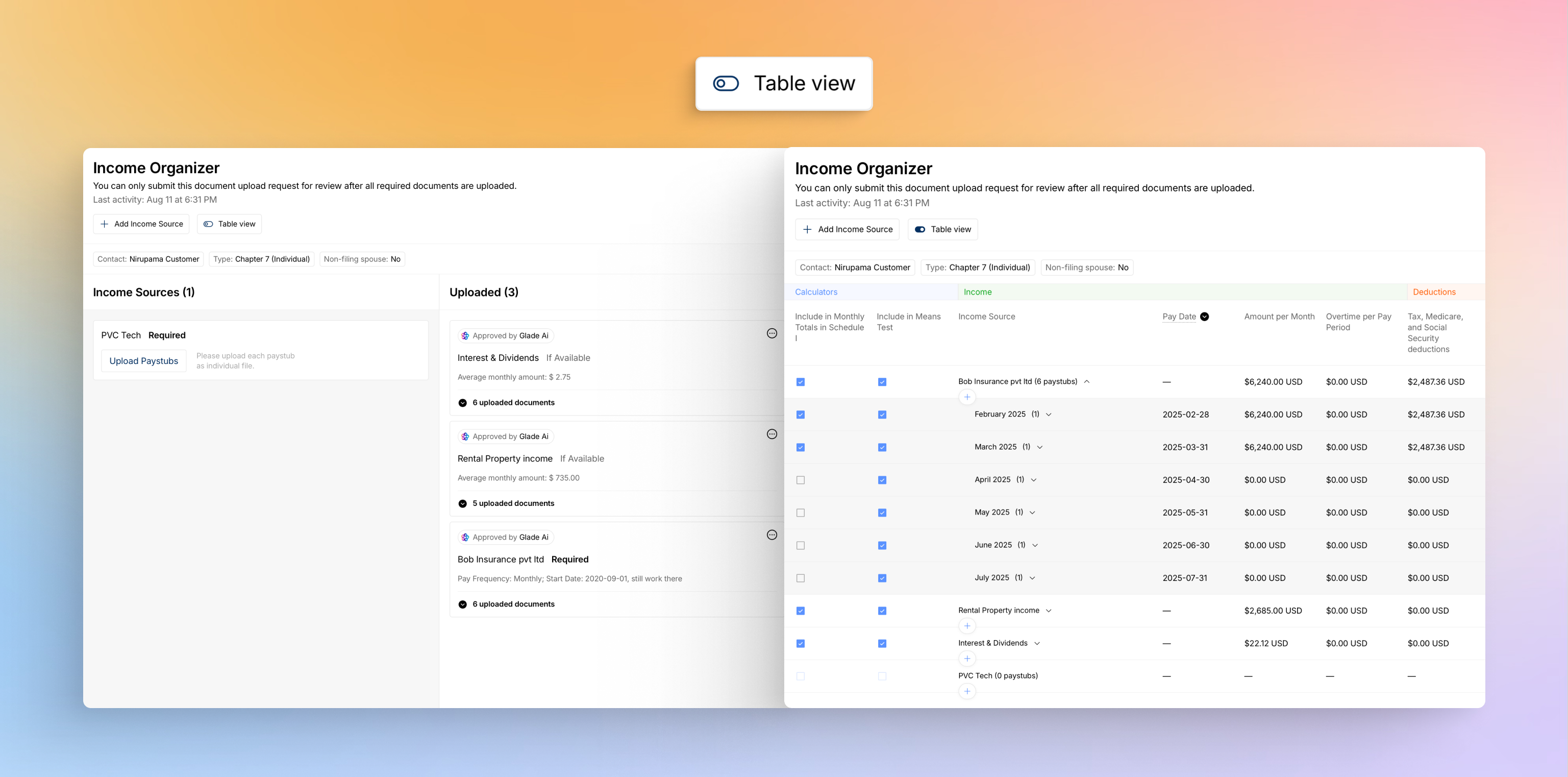

Two Views Available

Uploader View – Designed for clients to easily upload documents.

Table View – Ideal for attorneys and paralegals to analyze income and make adjustments.

To toggle between views, use the “Table View” toggle in the header.

How to Use the Income Organizer

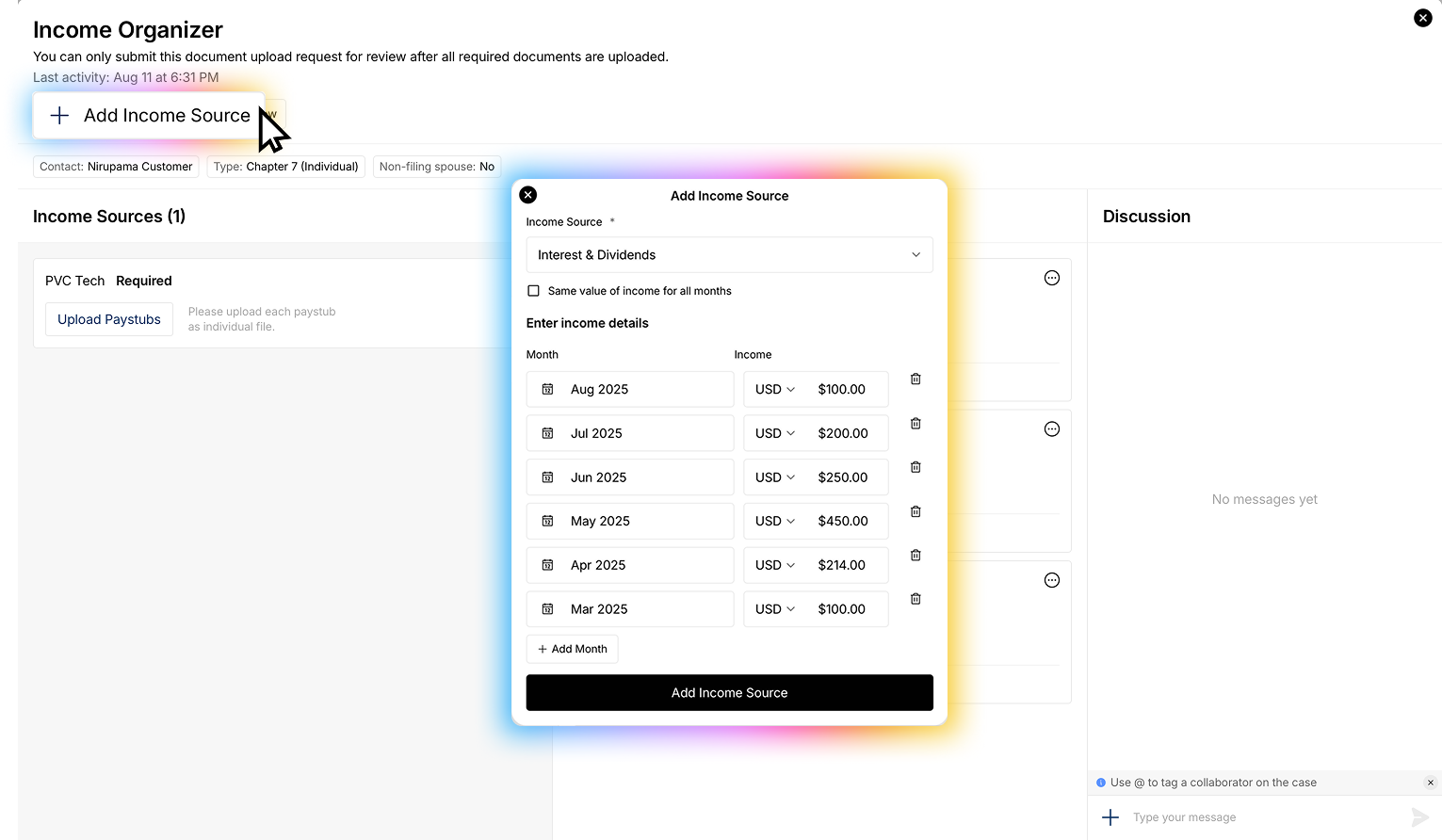

1. Add an Income Source

Anyone—attorney, paralegal, or client—can add an income source. You’ll enter:

Type of income (e.g., wages, rental income)

If employment income, you’ll add the employer name.

If non-employment income, you’ll add the income received for that income source over the past 6 months. You can add more months if you wish.

2. Add Income

“Income” refers to a payment event, such as:

A biweekly paycheck

Monthly unemployment benefits

Semi-weekly rental income

All income will be grouped by month within the pay table, showing you monthly income for each income source.

For employment income:

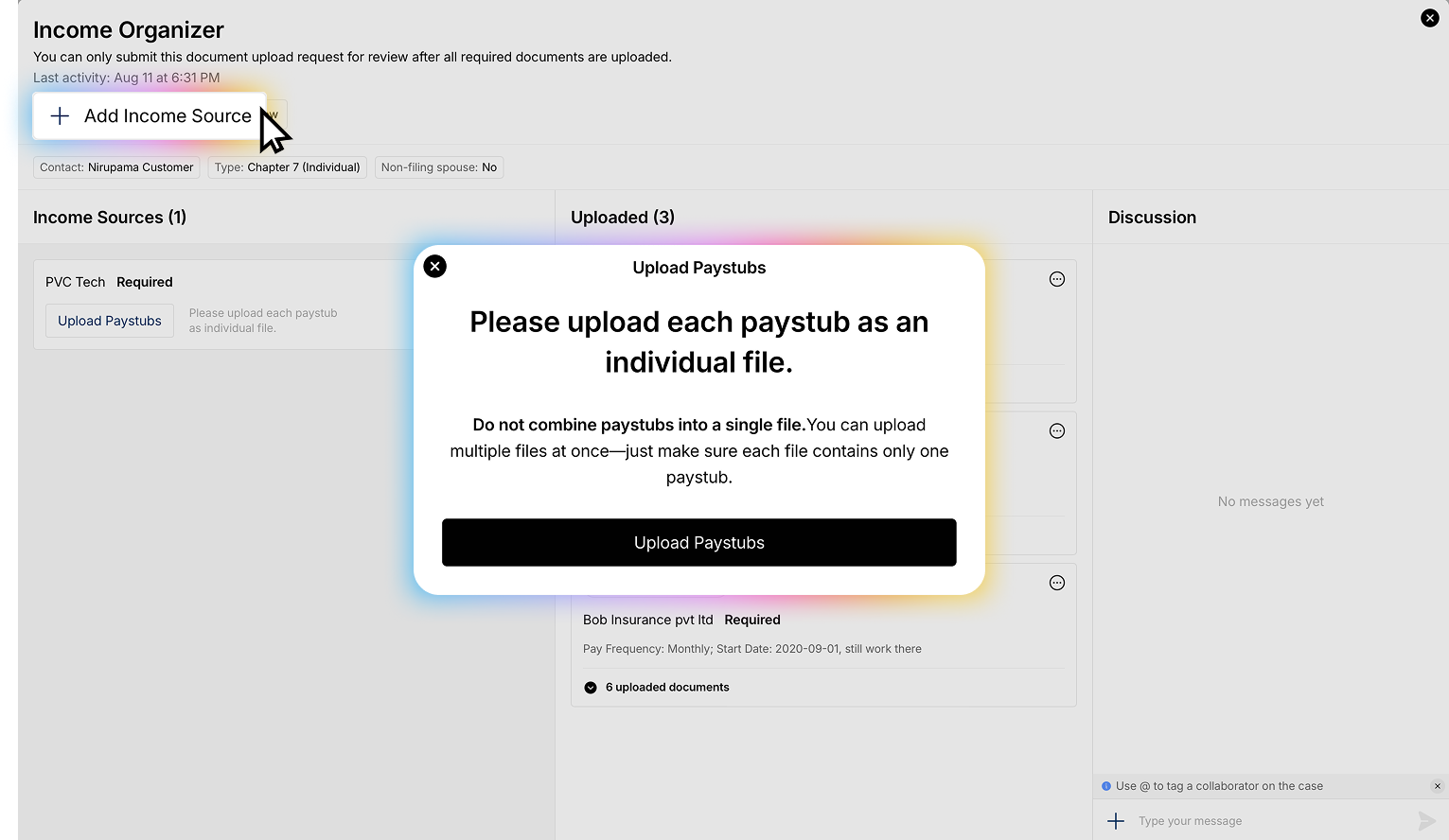

Upload pay stubs directly to the relevant income source folder.

For non-employment income:

Documents are optional, but you can upload them if desired.

Glade’s AI will extract relevant data from each uploaded income document.

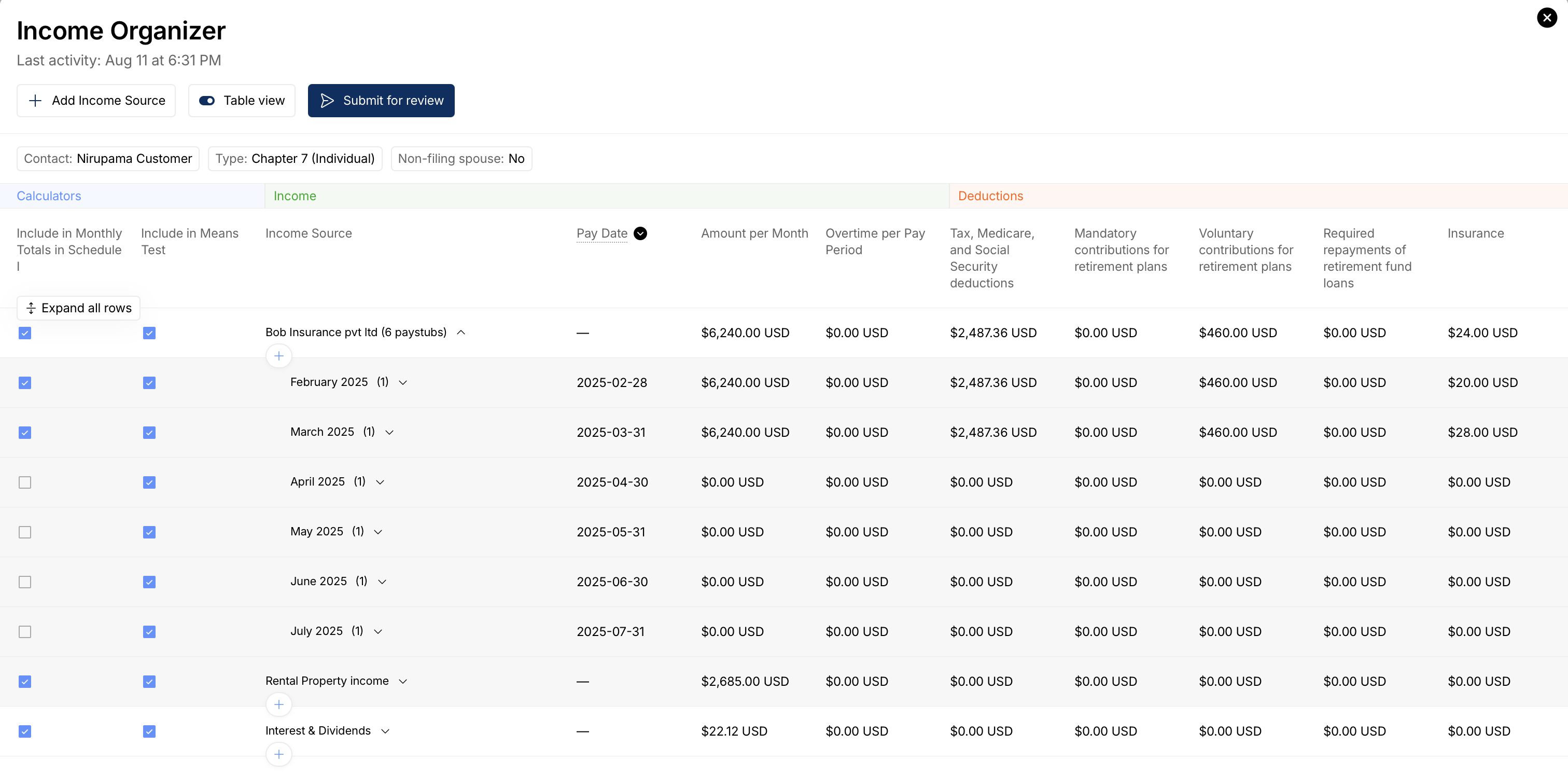

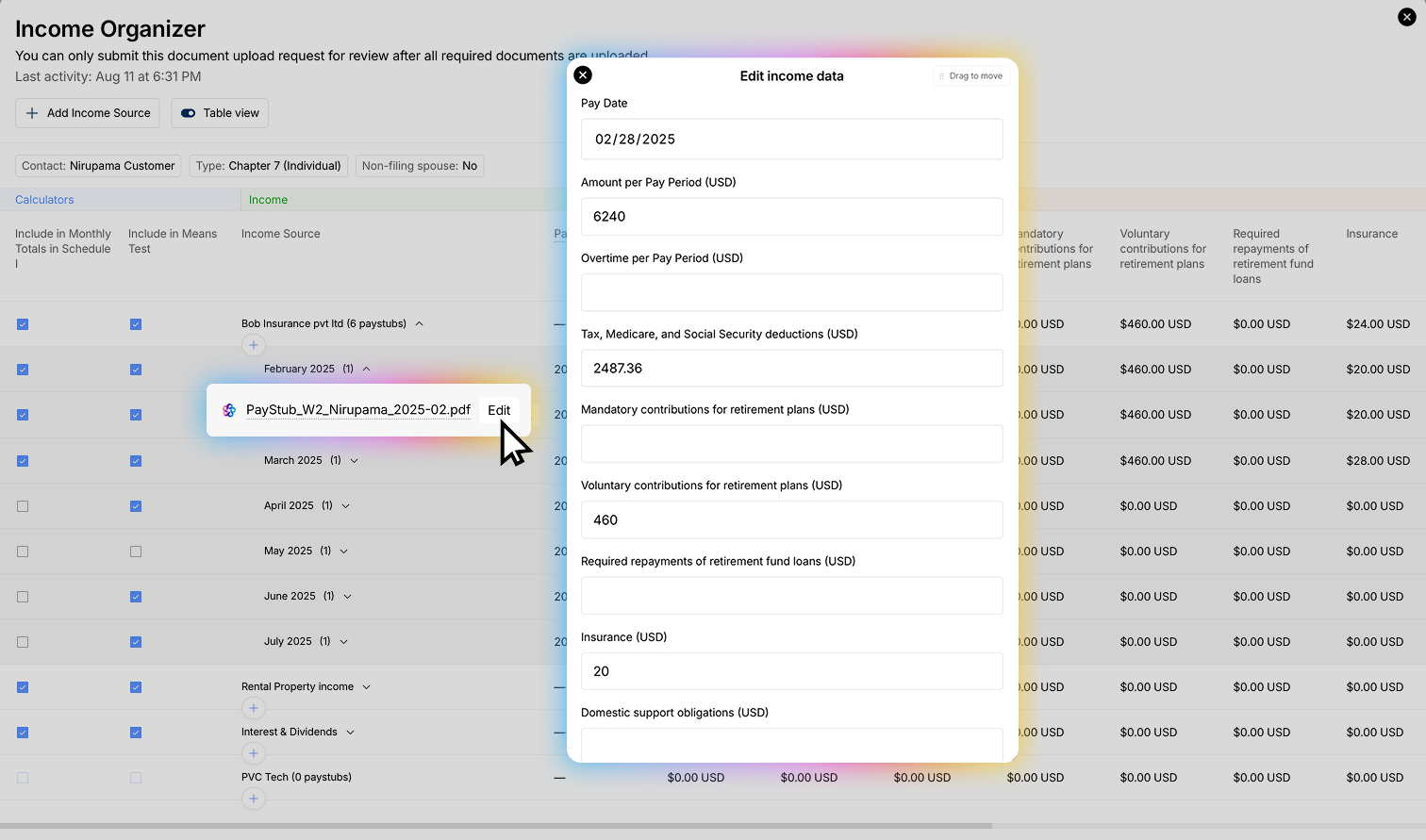

Editing Income with the Pay Table

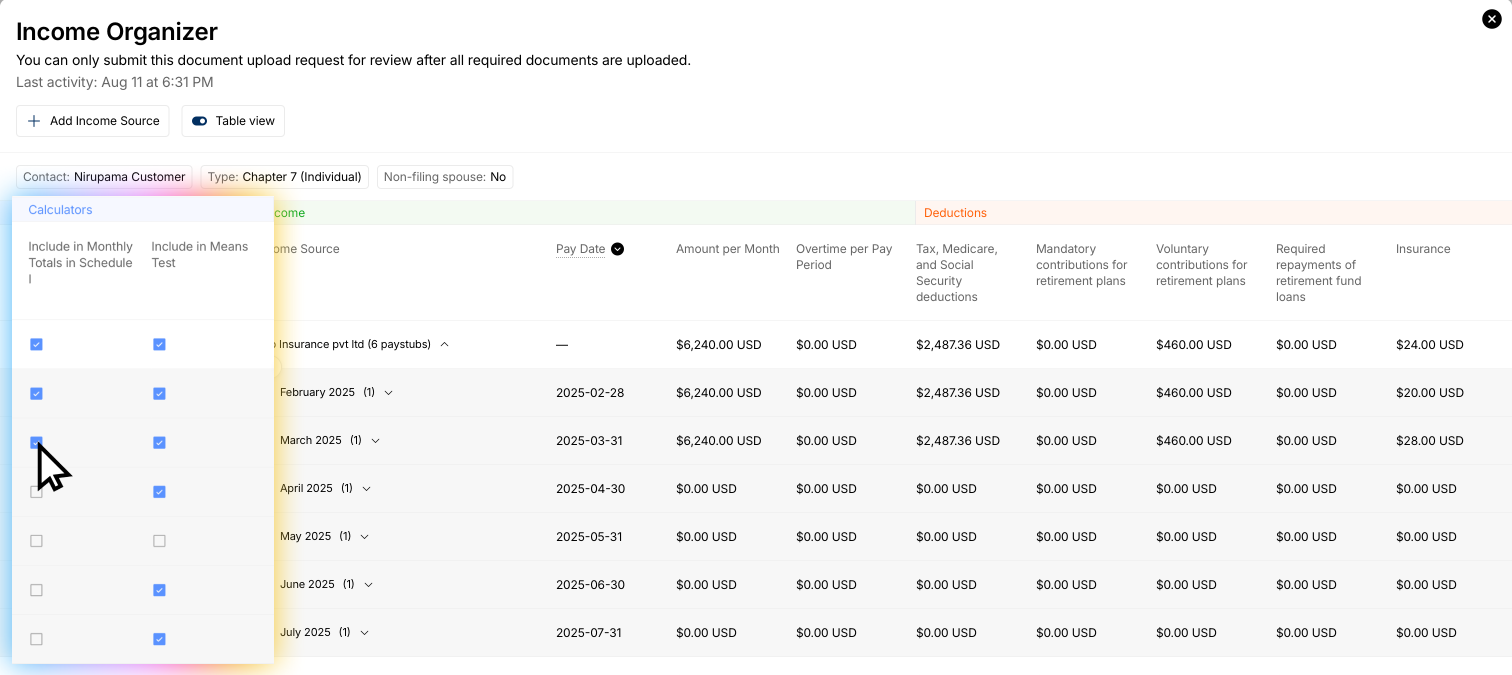

The Pay Table shows all income sources and associated payments. From here, you can:

Edit income source or payment details

Select which pay lines are included in:

Schedule I

Means test forms

Understanding the Pay Table Layout

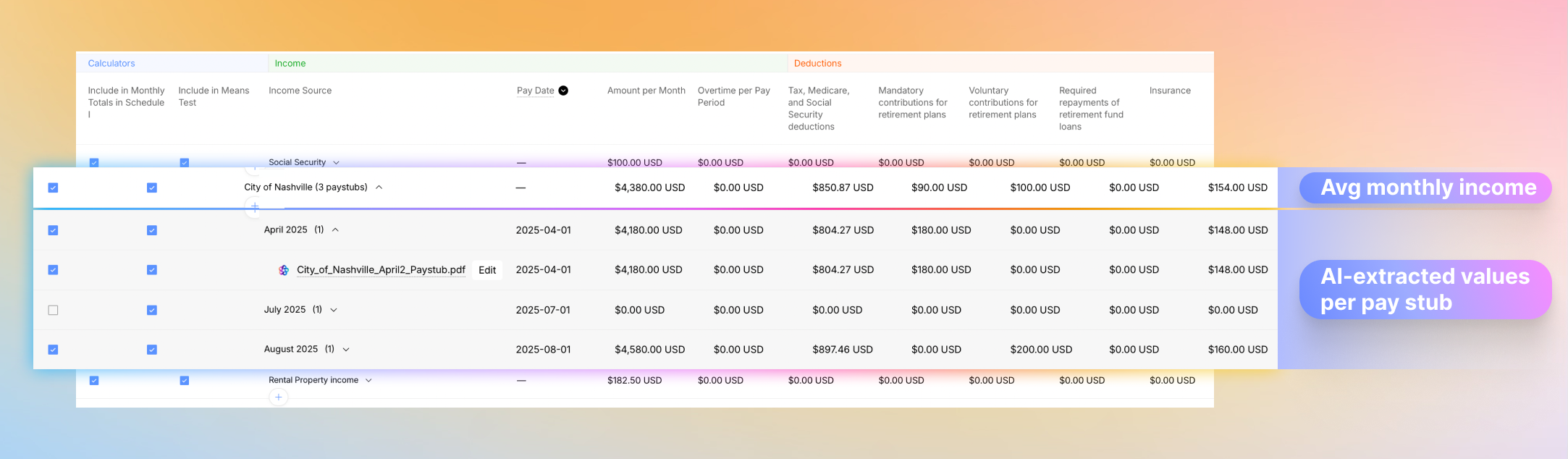

Income Source Row

Displays average monthly income for that source (based on selected stubs).

Income Row (Pay Stub)

Shows AI-extracted values per pay stub.

Fields are editable.

Includes a checkbox to:

Include the pay stub in Schedule I and average calculations

Or exclude it, keeping it in the case but omitting it from totals

Tip: To use only one representative pay stub for Schedule I, select that single stub. The rest will remain in the case but won’t affect the final numbers.

Schedule I Calculator

To view the calculators, click the ‘Calculators’ toggle at the top of the pay table. Doing so will reveal the calculators view on the right hand side.

The Schedule I calculator reflects line-by-line values matching Schedule I.

It will take all monthly values for employment and non-employment income and enter them into their applicable rows. Each row lines up 1:1 with those in Schedule I.

As you update the Pay Table, Glade AI automatically updates the Schedule I calculator in real time.

These values flow directly into Schedule I of the petition during the Schedules Builder process.

If you want to omit certain income from the Schedule I calculator, de-select the checkbox next to that pay item in the ‘Include in monthly totals’ column.

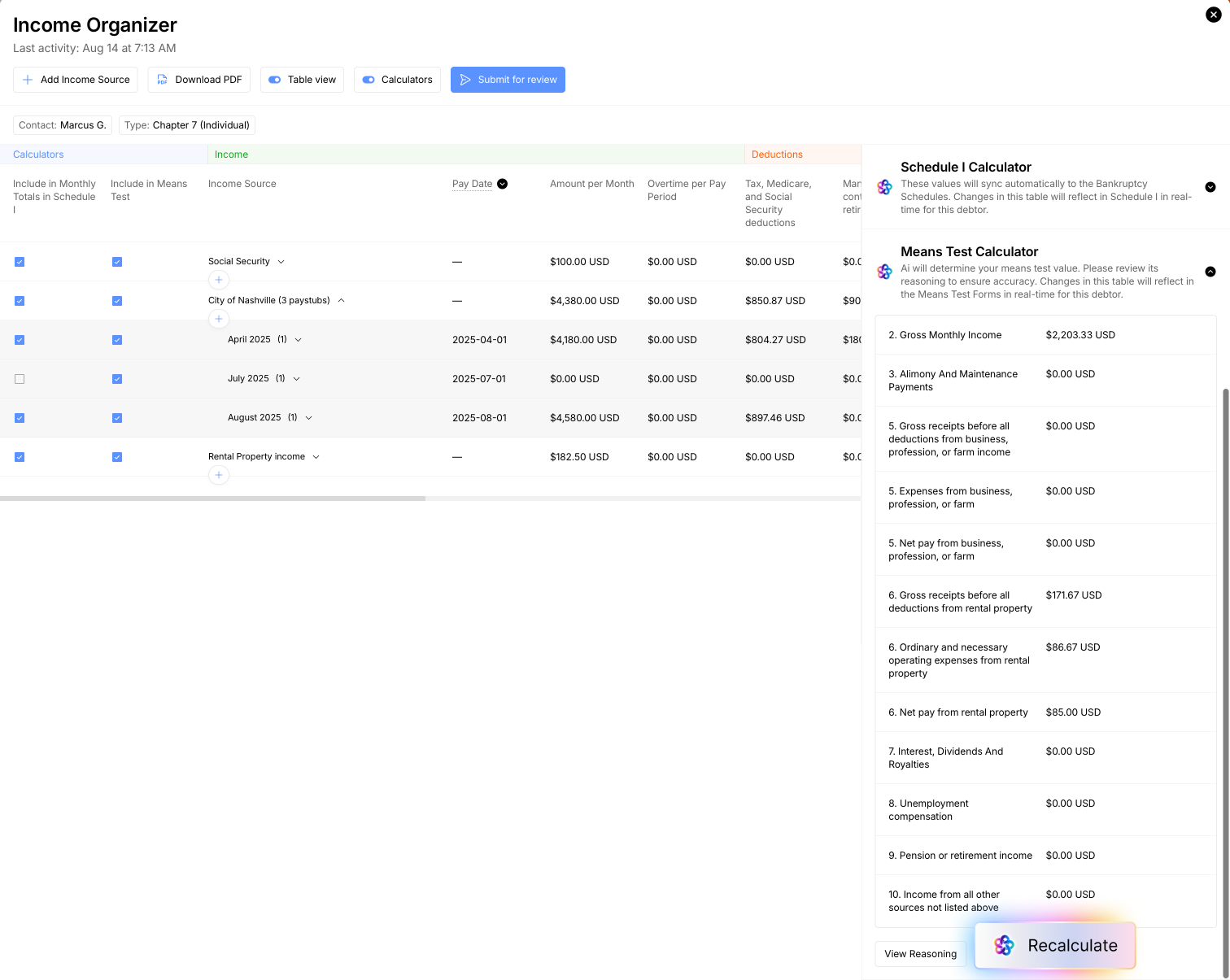

Means Test Calculator

Below Schedule I is the Means Test calculator.

To use it:

Click ‘Calculate’

Run it again any time changes are made

Glade AI will analyze the last 6 months of included income. In the Pay Table, each row includes a checkbox:

“Include in Means Test data” – deselect any income you want excluded.

After processing, the Means Test Calculator will display values, and you can review the AI’s logic or re-run the calculation if needed.