Credit Report Pulls - Client Approved

See how it works:

Overview

Glade offers the ability to pull client credit reports directly within your workflow. This feature streamlines the bankruptcy filing process by automatically using credit report data to populate the Schedules Questionnaire, helping attorneys file cases faster.

Benefits

- Automatically populates the Schedules Questionnaire with client credit information

- Reduces manual data entry and potential errors

- Accelerates the case filing process

- Simple client authentication process that takes approximately one minute

Process Steps

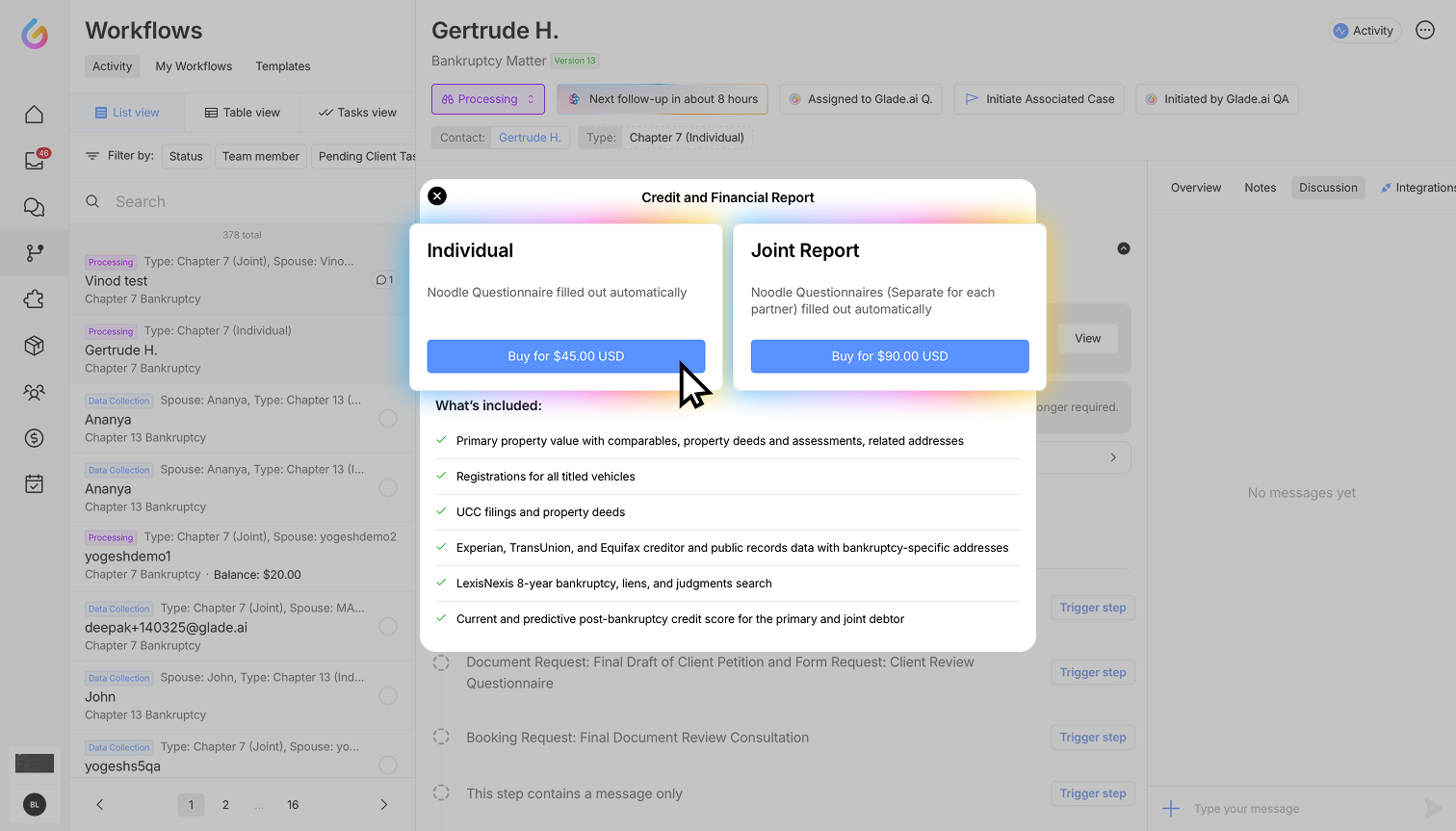

1. Initiate Credit Report Request

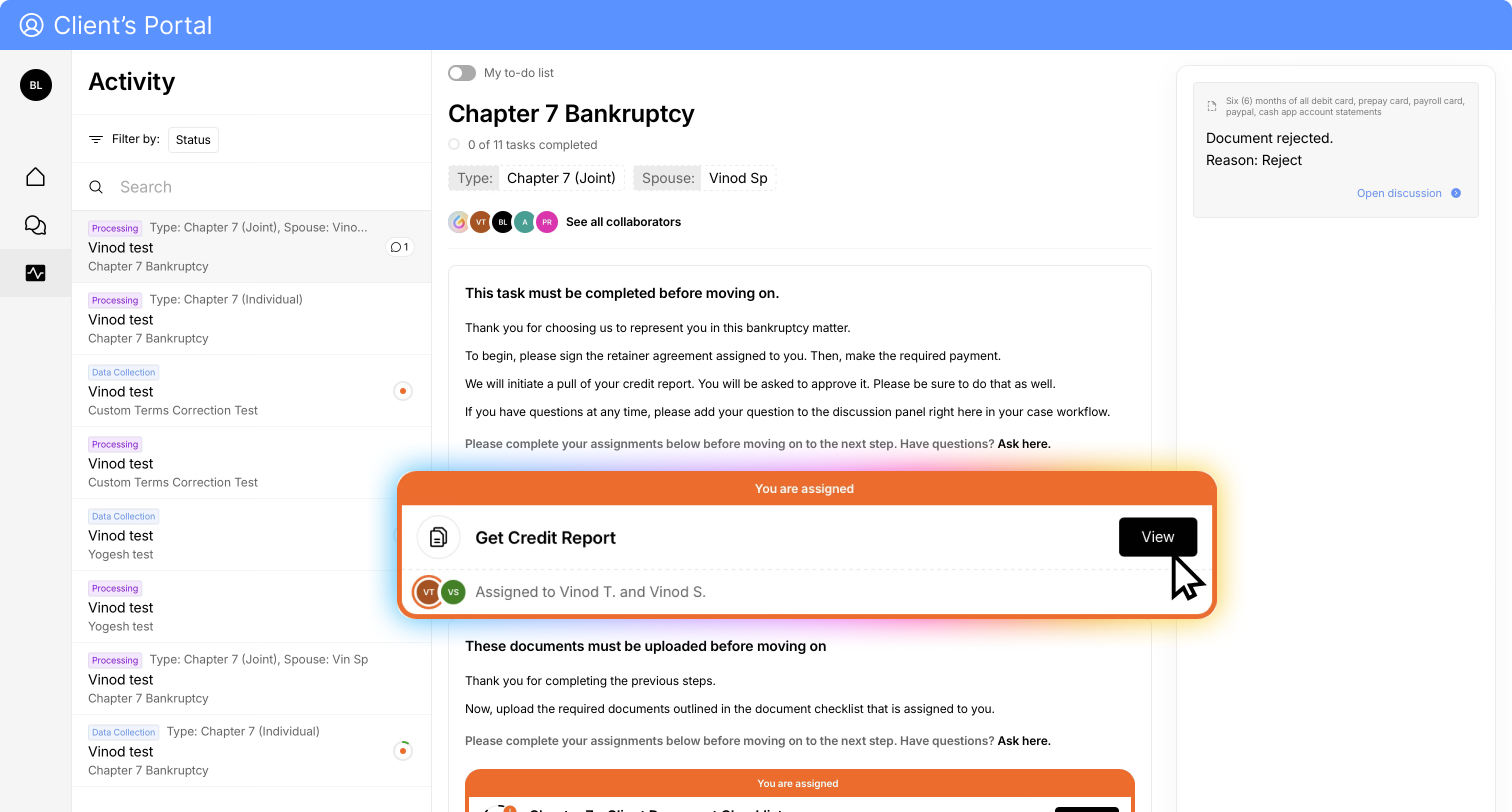

- Locate the "Get Credit Report" task in your workflow

- Click on the task to begin

- Select either "Individual" or "Joint" report type

- Select the client and click "Done"

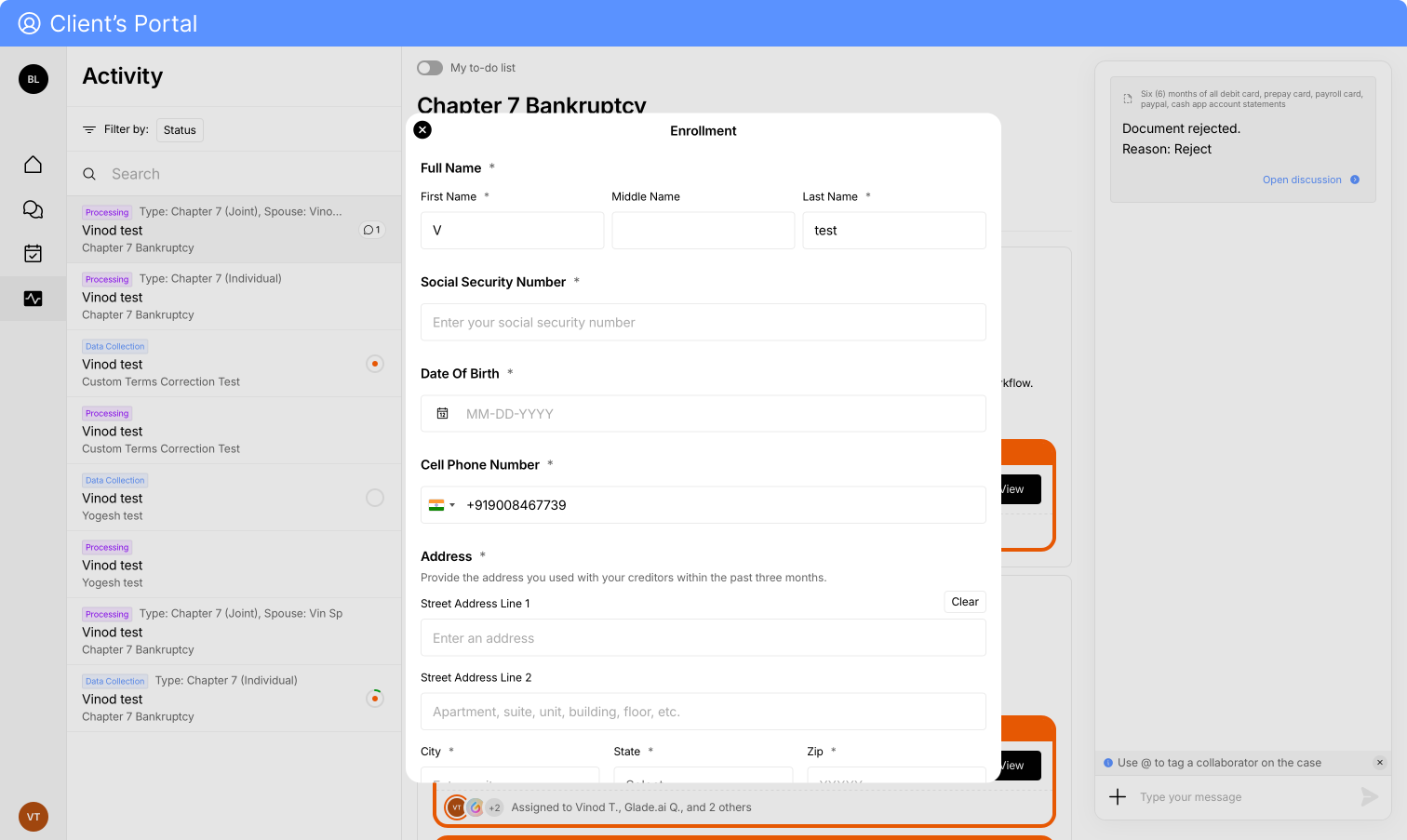

2. Client Authentication

- System automatically sends the client an email and SMS notification

- Client receives a form to enter their credit information

- Client completes identity verification through a text message link

- Verification process takes approximately one minute

3. Access Credit Report Data

- Once verified, the credit report is automatically pulled

- All credit data becomes available within your workflow

- Information is ready to use in the Schedules Questionnaire

Notes

- This feature is specifically for "Client-Approved" credit reports, which require client involvement

- A "Business-Approved" option is also available that doesn't require clien