Property, Assets, and Exemptions (Schedules AB, C)

HOW TO: Add Assets and Claim Exemptions in Glade's Bankruptcy Schedules Builder

Overview

Adding assets to Schedules A/B and claiming exemptions in Schedule C is a critical part of bankruptcy filing. Glade's Bankruptcy Schedules Builder automates much of this process with AI assistance for determining appropriate exemptions.

Benefits

Automatically imports associated properties from client credit reports

Includes default asset categories (vehicles, checking accounts, cash, retirement, etc)

AI-powered exemption recommendations based on state laws

Side-by-side comparison with official bankruptcy forms

Search functionality to quickly find specific assets

Process Steps

Select Exemption Approach

Choose between state/federal non-bankruptcy exemptions or federal exemptions

Your selection applies to all exemptions throughout the filing

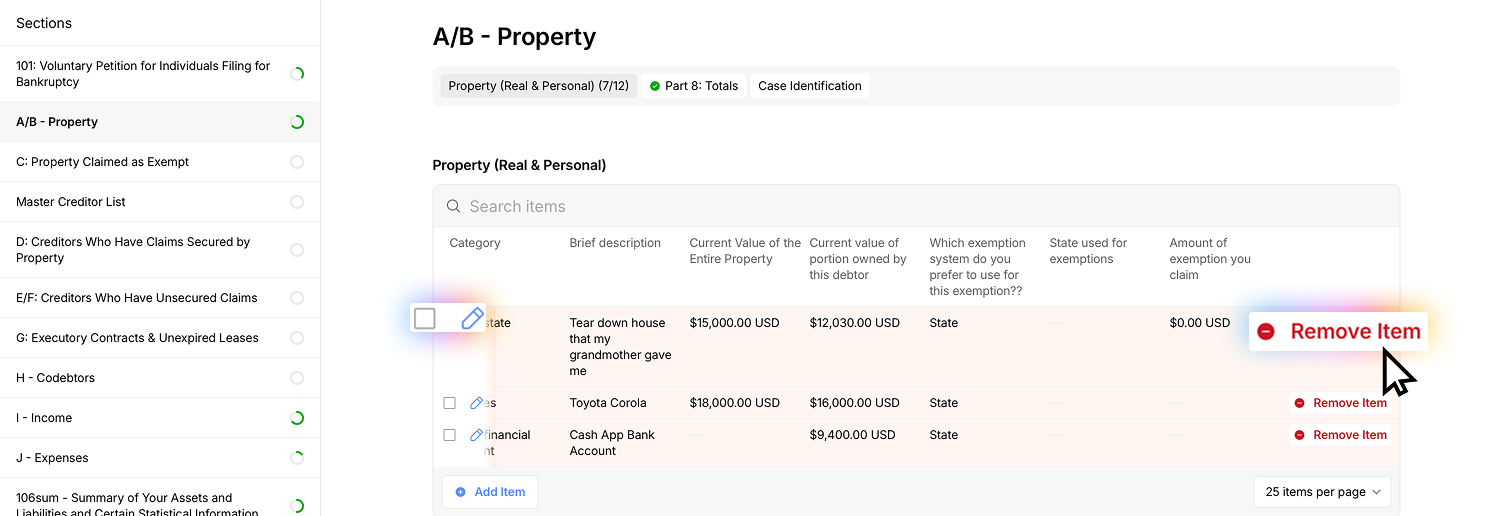

Review Pre-Populated Assets

System automatically includes assets from credit reports

Default categories appear (vehicles, checking accounts, cash, retirement, etc)

Remove unnecessary assets by selecting them and clicking "remove"

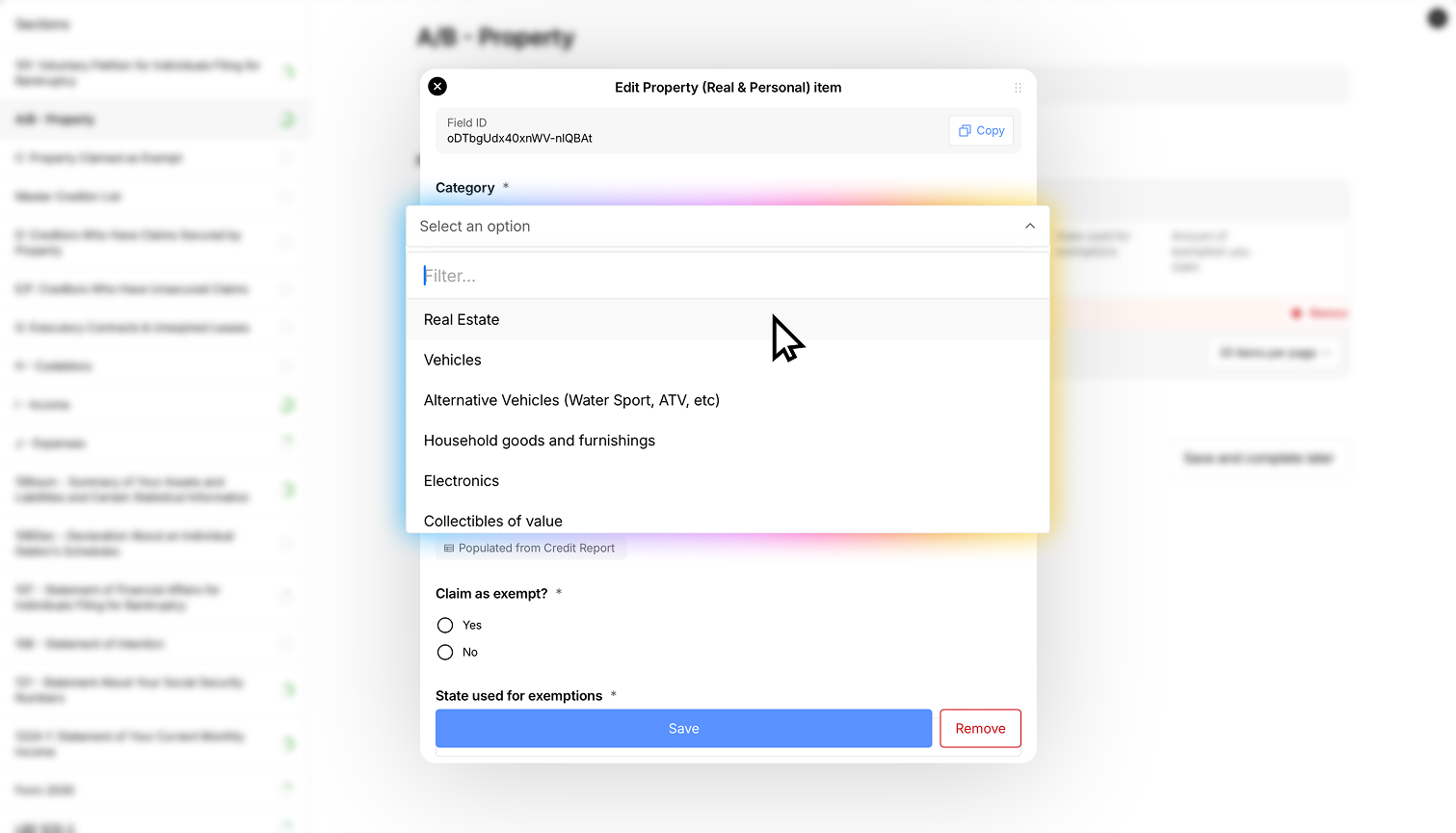

Add Additional Assets

Click "add item" to include assets not already listed

Select the asset type (real estate, vehicles, electronics, etc.)

Form fields will dynamically change based on the asset type selected

Complete all required information for each asset

Claim Exemptions

For each asset, scroll down and select "claim as exempt" if applicable

The system pre-fills:

State of filing

State vs. federal exemption preference

Specific laws allowing the exemption (from AI database)

Recommended exemption amount

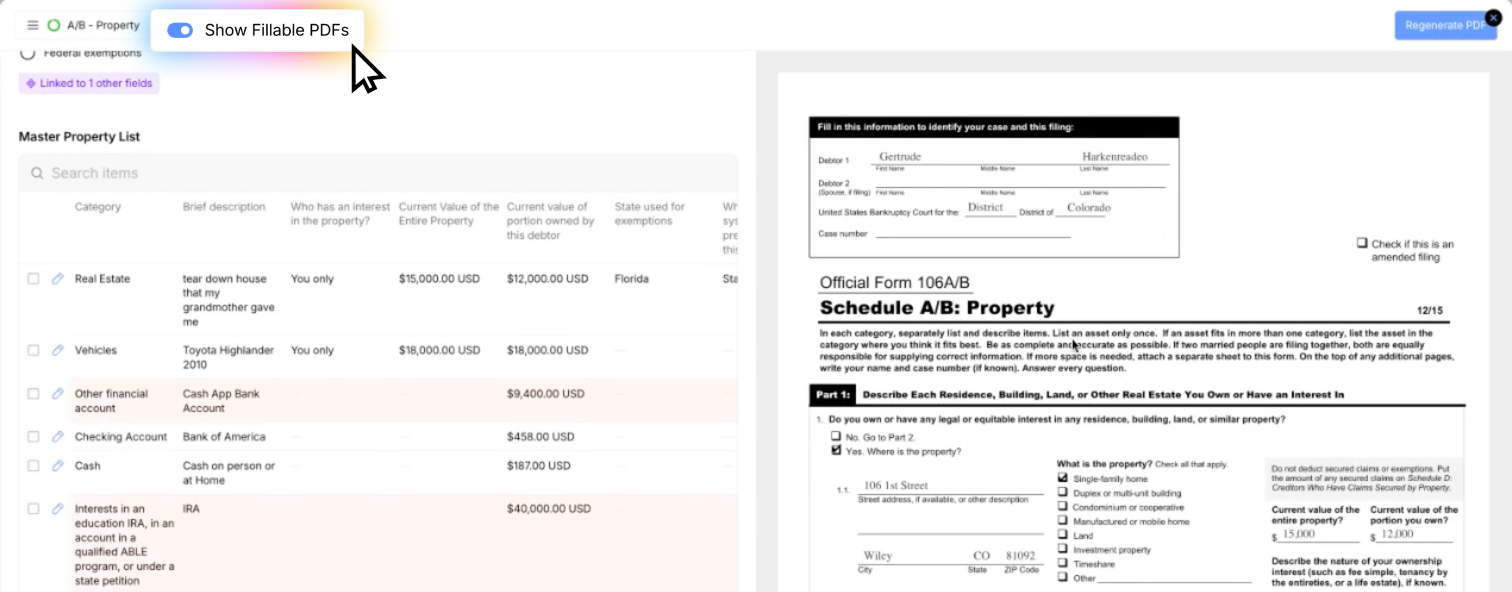

Review Completed Schedules

Click "show fillable PDFs" to view Schedule A/B

Click "regenerate" to update the form with your entries

Use the search function to locate specific assets or categories

Review Schedule C to confirm all claimed exemptions appear correctly

Notes

The AI provides transparency about how exemption recommendations are determined.

You can manually adjust AI-suggested exemptions as needed.

You can view and change exemption information - just click the 'Populated by Ai' button underneath the field to reveal the exemption data.

Everything marked exempt in the master property list automatically appears in Schedule C