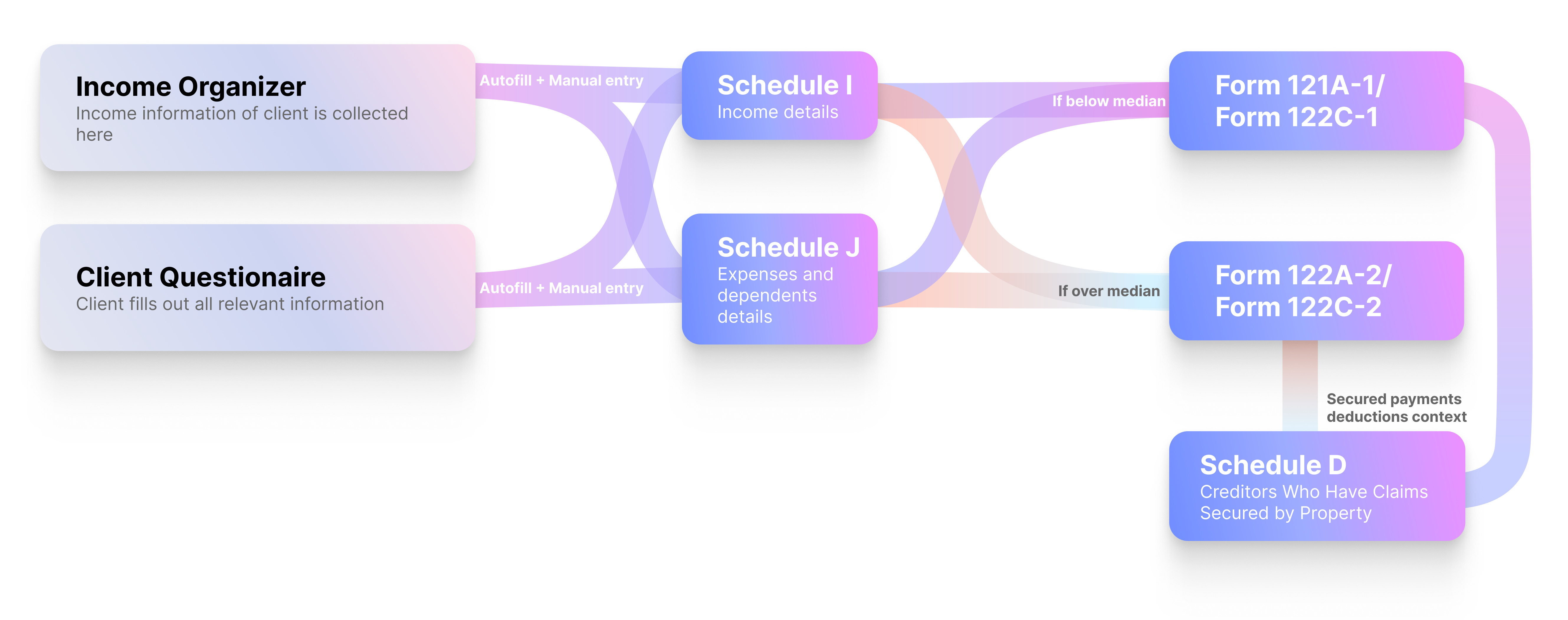

Means Test Forms (122A-1 & C-1, 122A-2 & C-2)

Means Test forms help determine a client's eligibility for Chapter 7 bankruptcy or their repayment obligations under Chapter 13, based on income, expenses, and family size. Glade simplifies your process of means test calculations for bankruptcy forms 122A1 and 122C2.

Here are the benefits of using Glade for bankruptcy filings:

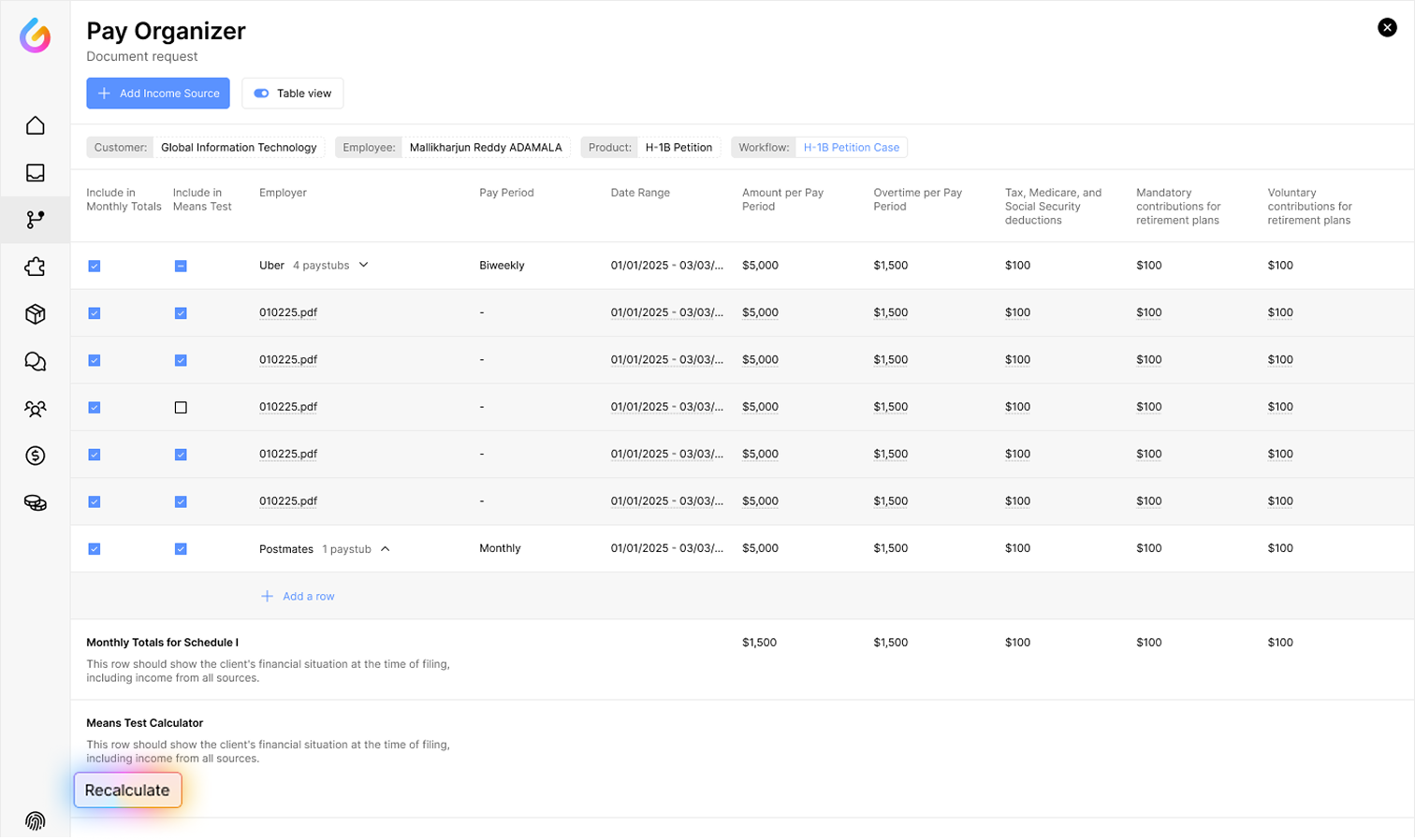

Helps collect all of the client's income data in a streamlined way through Pay Organizer

Easily determine whether the client is above or below the median income for the specific state through a single click from table view in Pay Organizer.

Easily select between different income sources to recalculate to match means test score.

Easily determine if it's possible to deduct per the IRS guidelines for allowable expense deductions, if the client is over the median

Here is how you can use this feature:

Open the workflow page for the client and click on Pay Organizer.

Review the uploaded paystubs in the Pay Organizer by clicking on Table view.

Select the checks boxes for incomes you want to include in the means test calculation

Click on Recalculate. System automatically recalculates means test values based on selections

You can view means test totals and verify calculations

Calculated values can be pulled into bankruptcy forms 122A1 and 122C2