Glade's Exemptions Agent

Guide to Using the Exemptions Agent in Glade's Bankruptcy Schedules Builder

Overview

This guide will walk you through using the new exemptions agent in Schedule A-B of the Bankruptcy Schedules Builder in Glade. The exemptions agent uses AI to automatically determine the appropriate exemption statutes and amounts for your assets.

Simply:

Step 1 - Add your assets into the Master Property List

Step 2 - Claim assets as exempt

Step 3 - click 'Run Exemptions Agent'

Step 4 - review for accuracy and make edits as needed

Step 5 - add custom instructions for your Ai if desired

Prerequisites

Access to Glade's Bankruptcy Schedules Builder

Your asset information ready (values, ownership details, etc.)

Step-by-Step Instructions

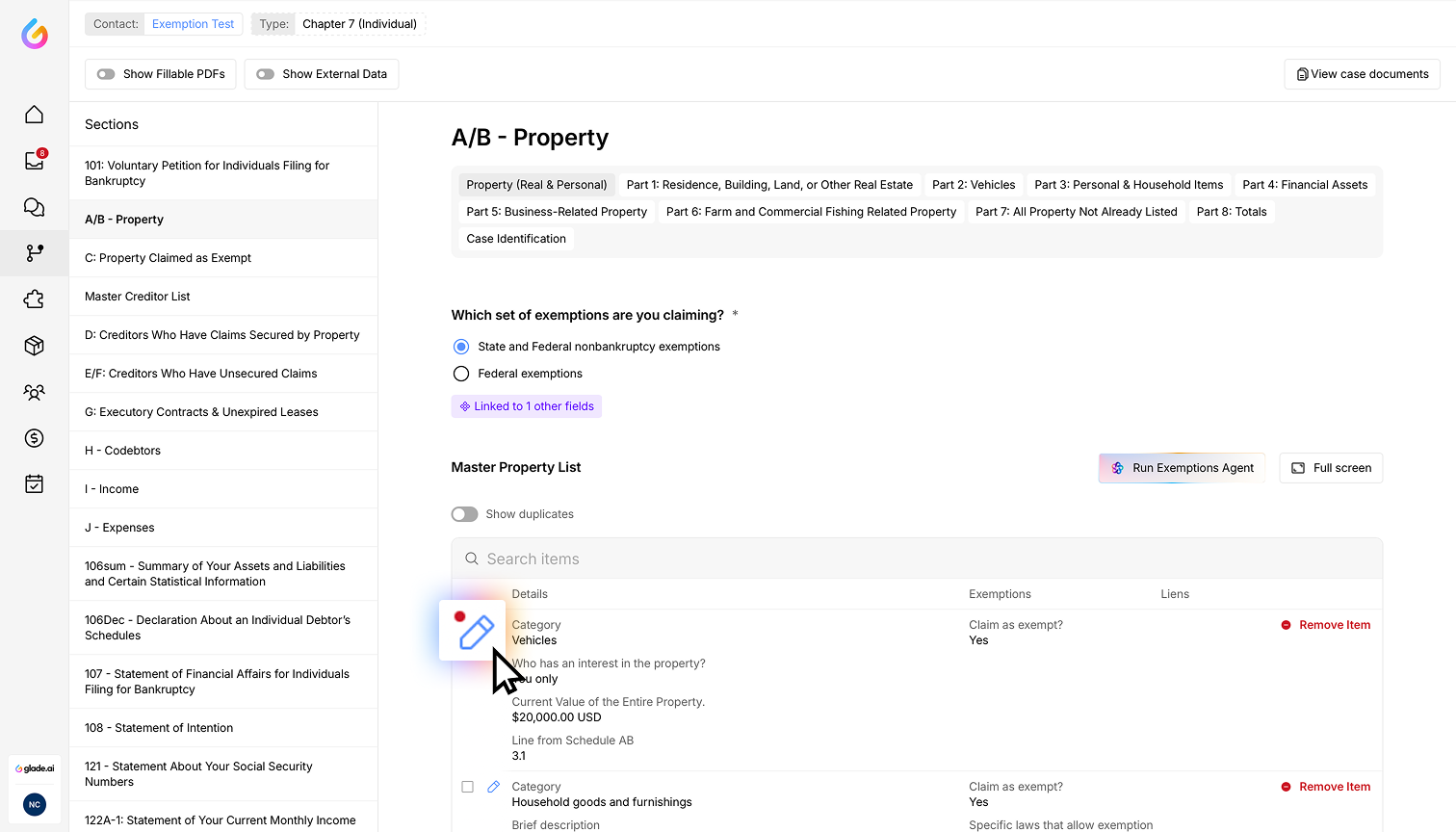

Step 1: Add All Assets to Schedule A-B

Navigate to Schedule A-B in your master project

For each asset you need to add:

Click to add a new asset

Select the appropriate category for the asset

Fill in all required information about the asset

Repeat this process until all your assets are entered into the system

Step 2: Claim Assets as Exempt

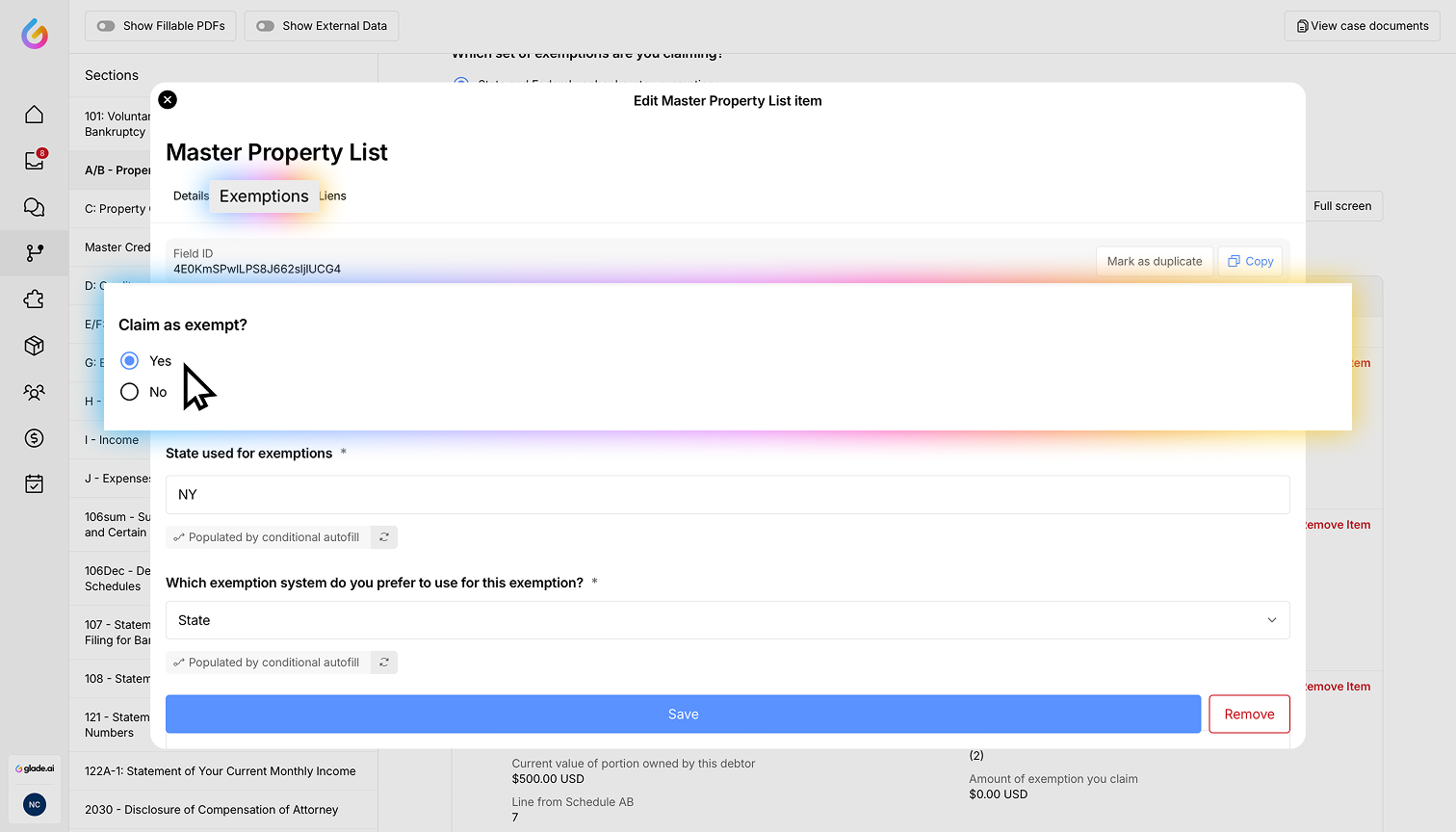

Review each asset you've added

For each asset you want to protect, mark it as "exempt"

When you claim an asset as exempt, the system will automatically fill in:

State used for exemptions (based on your state of filing)

Exemption system (based on your preference)

Setting Your Exemption System Preference

Before claiming exemptions, ensure you've selected your preferred exemption system:

Navigate to the exemption system field in Schedule A-B

Choose from:

State and federal non-bankruptcy exemptions

Federal exemptions

Your selection will apply to all assets by default

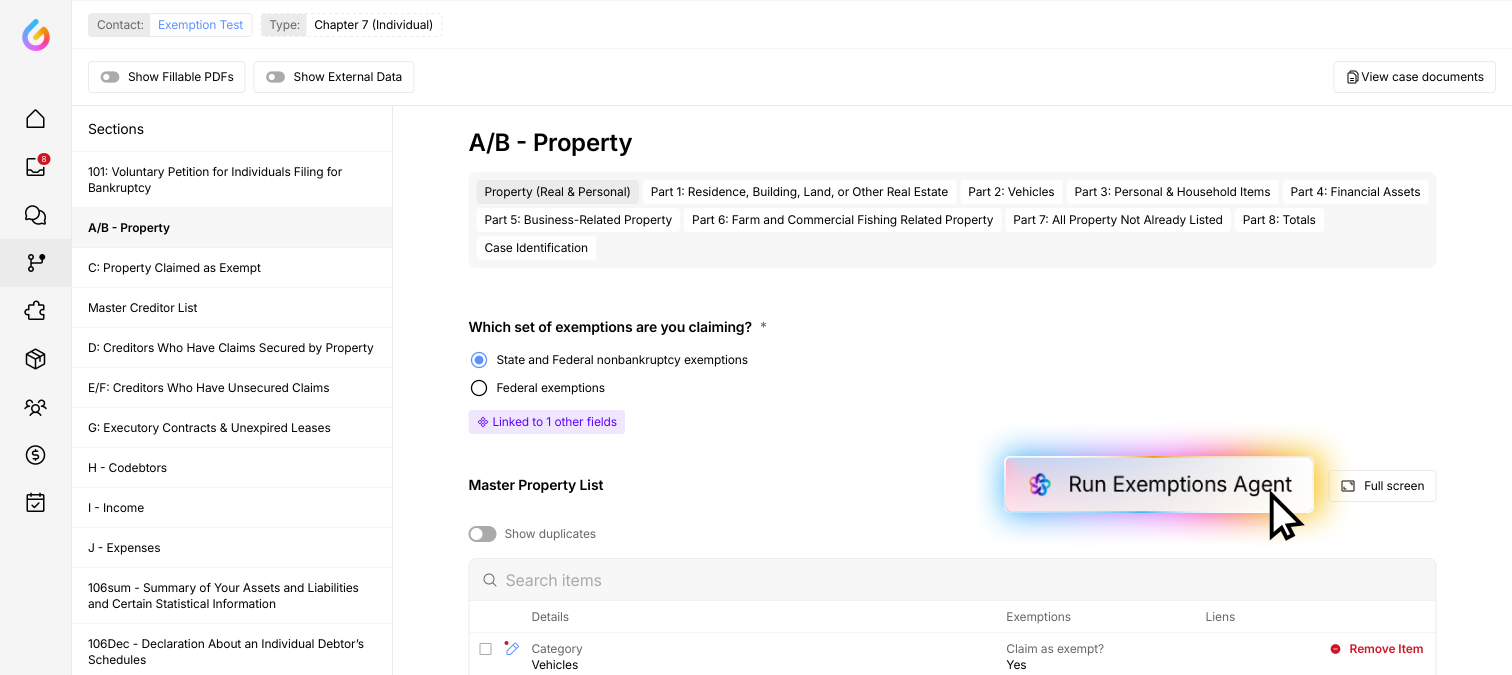

Step 3: Run the Exemptions Agent

Once all assets are added and marked as exempt, locate and click the "Run exemptions agent" button

The Glade AI will then:

Analyze each asset line by line

Determine the appropriate exemption statute

Calculate the maximum exemption amount available

Apply the exemptions based on your state's filing data

Step 4: Review AI-Generated Exemptions

After the AI completes its analysis:

Review each exemption by clicking on individual assets

Understand the AI's reasoning:

Click the information button next to the statute to see why that exemption was chosen

Click the information button next to the amount to understand the calculation

Check for special cases:

The AI will skip assets with $0 debtor ownership

For unlimited exemptions (like Florida's homestead), it will claim the full value

Example Reviews:

Real Estate: Check if homestead exemptions are properly applied

Vehicles: Verify the AI selected the correct vehicle (it prioritizes vehicles with debtor ownership)

Personal Property: Ensure appropriate category exemptions are used

Step 5: Make Adjustments if Needed

If you find any exemptions that need correction:

Manual adjustments: Edit individual exemption entries as needed

Custom AI instructions:

Go to your Profile

Navigate to Account settings

Add custom instructions for specific exemption types

The AI will use these instructions for future exemption calculations

Additional Features

Full-screen view: View all exemptions at once in full-screen mode for easier review

Detailed explanations: Each AI decision includes reasoning you can review

Automatic updates: The system remembers your preferences for future use

Best Practices

Double-check ownership percentages before running the agent

Verify state-specific exemptions match your filing state

Review unlimited exemptions (like homestead) carefully

Save your work regularly throughout the process

Troubleshooting

If an asset shows no exemption, check the debtor's ownership percentage

If wrong statutes appear, verify your state of filing is correct

For complex assets, consider adding custom instructions to guide the AI

Summary

The exemptions agent streamlines the bankruptcy exemption process by:

Automatically selecting appropriate statutes

Calculating maximum allowable exemptions

Providing transparent reasoning for each decision

Allowing manual overrides when needed

Remember to always review the AI's suggestions and consult with legal counsel for complex exemption strategies.